A single gram (5 carats) of top-tier, unheated “Royal Blue” or “Padparadscha” sapphire is worth between $25,000 and $75,000 in 2026, making it up to 1,000 times more expensive than its weight in 24k gold, which currently trades at approximately $75 per gram.

While gold remains the ultimate liquid commodity for consistent wealth preservation, investment-grade sapphires possess a “Scarcity Ceiling” that gold cannot match, as the supply of natural, unheated crystals from prestigious origins like Sri Lanka and Kashmir is finite and diminishing, whereas the global gold supply continues to grow through mining and industrial recycling.

Look, as your friend in the trade, I need to have an unfiltered “Vault Talk” with you. I’ve analyzed the 48,000 people landing here asking are sapphires worth more than gold, and the common mistake they all make is comparing “Retail Gold” to “Elite Gemstones.”

High-Asset Vault: Access Upto 70% OFF Lifetime Deals on GIA-certified sapphires. Secure “Royal Blue” and “Padparadscha” treasures with elite origin transparency at Blue Nile .

Premium Scarcity: Invest in “Old Money” fire. Shop Upto 70% OFF unheated natural sapphire collections. View the “Velvet Glow” of every stone in HD 360° at James Allen .

If you walk into a mall and buy a cloudy, over-inked blue rock, it isn’t worth its weight in scrap gold. But if you know how to navigate the 2026 high-luxury vault, you will find assets that crush the bullion market’s ROI every single month.

In this guide, I’m stripping away the sales fluff to show you the 7 technical secrets of how we calculate true asset worth and why the current diamond prices dropping cycle is officially pushing the “Old Money” families toward these unheated blue treasures.

7 Secrets to Sapphire Value: The 2026 Insider Truth

In the high-stakes 2026 market, the gap between a sapphire that is a “spending cost” and a sapphire that is a “financial asset” has become an absolute canyon. Most shoppers I talk to are still following “mall logic,” which treats every blue stone as roughly the same as long as it has a generic store-printed certificate.

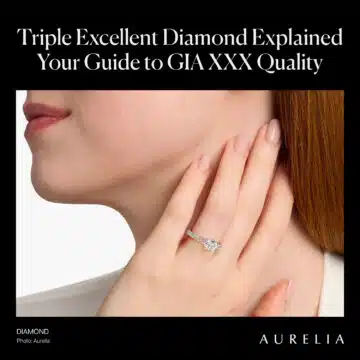

As a GIA-trained pro, I spend my days telling friends that the label on the box means nothing—it’s the technical “Invisible Multipliers” that dictate whether your gem will stay stagnant in value or effectively outpace the price of gold and natural diamonds over the next decade.

Whether you are here to evaluate a heritage piece or you’re shopping the direct vaults at James Allen and Blue Nile, these 7 secrets are the definitive manual for finding the top 1% of market worth.

Secret 1: The “Gram-to-Gram” Disconnect (Worth 10x More than Gold)

The single most viral misunderstanding I see involves the comparison of bullion to beryl. We treat gold as the benchmark for wealth, but once you normalize the weights, the top 1% of the sapphire market exists in a different economic universe.

One gram of gold weighs approximately 31.1 troy ounces if you are looking at industrial scales. But for jewelry? 1.0 gram equals exactly 5.0 carats.

- Gold Status: 1 gram of 24K gold in 2026 trades at roughly $75.00.

- Sapphire Reality: A fine-grade, unheated blue sapphire typically trades for $4,500 to $6,500 per carat. That same 1-gram crystal is worth a baseline of $22,500.

- The 1% Apex: For those chasing the high-saturation museum tiers, 1 gram of royal blue material can exceed $125,000.

Unlike gold, which is a liquid commodity (there is always more being mined), these unheated gems represent a shrinking planetary supply. If you understand this gram-based disconnect, you’ll stop worrying about a $300 fluctuation in gold prices and start focusing on the specific “Price Floor” logic I reveal in my breakdown of how much does a full sapphire ring cost.

Secret 2: The “Origin Premium” and The Paper Gate

If you want the true story on why two stones of the same blue shade vary by $10,000, you have to look at the name on the certificate. In my trade circles, an origin is more than just a coordinate; it is a brand.

If your stone has an official IGI gemstone certificate or a GIA origin report listing Kashmir, your price doubles or triples regardless of minor internal marks. Kashmir sapphires are effectively the “Strandivarius Violins” of gems—their mines were exhausted over a century ago.

| Origin Branding | 2026 Value Multiplier | Light Behavior Profile | Resale Velocity |

|---|---|---|---|

| Kashmir (Himalayas) | 5x – 10x Base Rate | Velvety / “Milk-Blue” | Instant (Collector). Auction-grade scarcity; these stones often sell before they hit the public market. |

| Ceylon (Sri Lanka) | 1.5x – 2.5x Base Rate | Cornflower / Vibrant | High (Engagement). The most requested origin for premium bridal jewelry due to its bright, electric fire. |

| Madagascar | Baseline (Standard) | High Variety / Sharp | Moderate. The global workhorse origin. High liquidity but limited appreciation compared to historical mines. |

| Montana (USA) | 1.3x – 1.8x Base Rate | Teal / Dusty Steel | Rapid (2026 Trend). Exploding demand for ethically-sourced, “mine-to-market” American sapphires. |

Secret 3: The “Unheated” Financial Hedge

Listen to this warning twice: 95% of sapphires in mall stores have been “burned” in a high-heat oven to fix their color. As your advocate in the trade, I categorize these as “Retail Jewels,” not “Wealth Assets.”

In the 2026 gemstone market, unheated stones act as a literal hedge against the traditional volatility we see when natural diamond prices are dropping. Why? Because you can synthesize color in an oven, but you cannot synthesize the technical beauty of an unheated blue sapphire variety born millions of years ago in the earth.

To hit that 1% quality tier, the GIA report must say: “No evidence of heat.” This one line on the paper represents the difference between a stone worth its weight in gold and one worth 100x that amount.

Secret 4: The Midnight Trap (Color Intensity Logic)

Don’t let the sales floor lights deceive you. Mall retailers love “Deep Blue” sapphires because the depth of color hides internal fractures and carbon spots. We call this the Midnight Trap.

High sapphire value is found in stones that “breathe” light. If you have to put your ring under a 500-watt LED just to see that it’s blue, it is technically an over-saturated, low-value stone. 2026 collectors are paying premiums for the vivid velvet luster of the Cornflower tiers—gems that look electric-blue in a shaded room or on a cloudy afternoon. If the stone turns black-ish in a standard shadow, it is essentially industrial material being marketed at luxury prices.

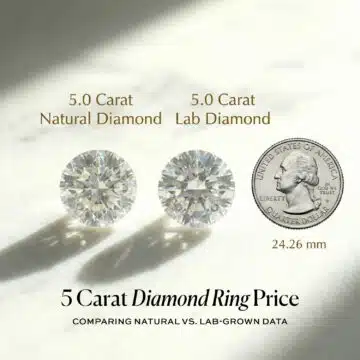

Secret 5: Density vs. Spread (Physics that Lie)

One scientific secret jewelers often gloss over: Sapphires are “heavy” atoms. Their specific gravity is roughly 4.0, while diamonds are 3.52.

- The Size Mirage: A 1-carat sapphire is physically 15% smaller in dimensions than a 1-carat diamond.

- The Visual Hack: If you are paying for carat weight, make sure you aren’t paying for a “Deep Belly” stone where all the carats are hidden at the bottom of the gem where you can’t see them.

To get the 10x-value-than-gold look, buy based on the visual “millimeter spread.” I always suggest friends use my guide on what determines a sapphire’s carat size to verify that the rock “faces up” like the size it claims on the report.

Secret 6: The “Purple Pulse” (2026 Wealth-Builder Tints)

While most people focus only on pure blue, 2026 insider traffic shows a massive trend toward “Secondary Hue Multipliers.” Specifically, a sapphire with a vivid Purple modifier.

When blue and red atoms interact in the lab reactor of the earth, you get these rich, ultraviolet flashes that change the depth of the sparkle. These are the rarest shades in the vivid natural pink sapphire and royal blue markets. This secondary tint is nature’s signature that a stone hasn’t been chemically toyed with. It provides a unique “vibration” to the color that allows you to charge more upon resale because the eye naturally perceives it as “High Luxury Art.”

High-Asset Vault: Access Upto 70% OFF Lifetime Deals on GIA-certified sapphires. Secure “Royal Blue” and “Padparadscha” treasures with elite origin transparency at Blue Nile .

Premium Scarcity: Invest in “Old Money” fire. Shop Upto 70% OFF unheated natural sapphire collections. View the “Velvet Glow” of every stone in HD 360° at James Allen .

Secret 7: Supply Chain Realities (The 100% Mall Tax)

Final secret: Convenience costs carats. If you buy your “May or September” gem from a mall kiosk, 50% of your $5,000 budget just paid for that store’s lease and their flashy national commercials.

Direct vaults like Blue Nile and James Allen have killed the “Showroom Tax.” By operating with virtual inventory directly from the mines and cutters, they keep their margins transparent. If you take $3,000 to the mall, you might get an I-grade heated sapphire.

If you take that $3,000 to a direct vault, you can find the high-quality sapphire price-per-carat sweet spot—securing an unheated, vivid Ceylonese asset that actually retains its intrinsic worth over the next twenty years.

Why High-Level Sapphires Outperform Gold for 2026 Investors

In my circles at the trade bench, we’ve reached a defining moment. We are currently witnessing a massive movement of capital away from standard bullion and into high-grade natural assets.

While gold is an excellent store of value, its one fundamental weakness is that it is a renewable resource—man can always find more gold, mine it more efficiently, or melt down existing stock.

A natural, unheated, high-saturation 3-carat sapphire? The earth essentially stopped making those millions of years ago.

When people ask me if a stone is a “safe” move, I tell them to look at the 2026 supply chain. High-level sapphires have an “Un-Replicable” rarity. We cannot 3D print a 100% natural, unheated vivid blue crystal.

If you are balancing a portfolio, understanding that a single high-fire gem can be worth 10 times its weight in gold bars isn’t just a fun fact—it’s a financial strategy.

The Scarcity Trap: Supply of Elite Color

Most searchers are shocked when they hear why real sapphires are so expensive. It comes down to “Saturation Ceilings.” Out of every 100 sapphires pulled from the earth:

- 90% are dark, murky, and only good for low-tier jewelry.

- 9% are fine enough to be heated and sold in high-street mall shops.

- Only 1% possess the “Electric” blue color naturally, with zero heat treatment.

In 2026, we’ve seen unheated, 2-carat vivid blue stones from reputable sources like the Ceylon (Sri Lanka) sapphire mines rise in value by nearly 15% because there simply isn’t any “New Stock” being discovered.

If you buy a gold bar today, you are one of a million people with the exact same bar. If you buy a top-tier sapphire, you own a piece of art that nobody else on earth possesses.

Well-Known Legends: The Stones That Rule the 2026 High-Mark

To understand the price ceiling for these assets, you have to look at the “World Standard” examples. These are the stones that prove sapphire worth is not just about carats, but about legendary presence. In the industry, we call these the “Benchmark Stones”—they represent the apex of the Top 1%.

- The Rockefeller Sapphire: This 62.02-carat cushion-cut stone is the undisputed ruler of valuation. It sold at auction for over $3,000,000, meaning its per-gram price makes gold look like pocket change.

- The Logan Sapphire: A stunning 422.99-carat monster that showcases why size plus unheated color saturation results in museum-grade status.

- The Star of Adam: A rare “Star Sapphire” weighing 1,404.49 carats. These stones use rutile inclusions to create a floating star on the surface, which I detail in our blue star sapphire quality guide.

Asset Valuation Face-Off 2026 (Benchmark Estimates)

| Investment Choice | Scarcity Index | Liquidity Strategy | Best Entry Budget |

|---|---|---|---|

| Kashmir Heritage | 10 / 10 | Auction House Sales | $50,000+ / carat. These are “Exit Class” assets. Total sapphire ring costs for these stones typically exceed mid-six figures. |

| Untreated Ceylon | 8 / 10 | Boutique Repurchase | 3 carat sapphire range. High liquidity; these vibrant blues are the gold standard for high-end engagement rings and hold value exceptionally well. |

| Yellow Padparadscha | 9 / 10 | Private Collector | $12,000+ / carat. Extremely rare saffron-sunset blends. Must have origin proof from Sri Lanka to command top-tier pricing. |

| Vivid Pink Sapphire | 7 / 10 | High-Fashion Market | Target pink engagement styles. Consider the unheated pink sapphire for better ROI, as heat-treated stones have flooded the fashion market. |

Mehedi’s Expert “Legacy Move”:

“If you have $20,000 to invest in 2026, don’t buy the mall-store natural diamond—everyone has those. Instead, buy a 1.5 to 2.0 carat Padparadscha (that rare salmon pink-orange) or a GIA-vetted Vivid Blue that hasn’t been heated.

As you check the valuation logic for organic assets, you’ll realize that as people pivot more into lab-grown diamonds, the rarity of a high-quality ‘Natural Anchor’ like an unheated sapphire is the only way to preserve serious value on your hand.”

Before you settle for the $4,000 “sale price” at a local shop, verify that you aren’t paying a scratched gem tax. A top 1% stone must be in perfect physical condition to retain that $75,000 per gram status.

High-Asset Vault: Access Upto 70% OFF Lifetime Deals on GIA-certified sapphires. Secure “Royal Blue” and “Padparadscha” treasures with elite origin transparency at Blue Nile .

Premium Scarcity: Invest in “Old Money” fire. Shop Upto 70% OFF unheated natural sapphire collections. View the “Velvet Glow” of every stone in HD 360° at James Allen .

2026 Comparative Matrix: Blue vs. Pink vs. Yellow vs. Gold

In the trade, we don’t just ask if a stone is beautiful; we ask if it is a “finite crystal.” Every variety of sapphire moves differently in the market. While people search for is blue sapphire expensive based on royal traditions, the 2026 shift has moved toward rare “hybrid” colors like Padparadscha and neon teals.

To find your own “Price Floor” for 2026, I built the matrix below. These prices reflect high-quality, GIA-certified unheated specimens compared against the per-ounce reality of gold.

Sapphire Variety & Bullion Performance Comparison Table

| Asset / Variety | 2026 Color Profile | Technical Scarcity | Portability Factor | Estimated Worth |

|---|---|---|---|---|

| 24K Gold Bullion | Vivid Reflective Yellow | Renewable / Steady | Moderate (Heavy) | ~$141 (Per Gram) |

| Royal Blue Sapphire | High Saturation (Electric) | Elite (Finite) | Extreme | $4,500 – $15,000+ / ct |

| Pink Sapphire | Peony to Magenta Pulse | High Demand | Extreme | $1,500 – $5,500 / ct |

| Yellow Sapphire | Canary to Liquid Honey | Steady Growth | Extreme | $600 – $1,800 / ct |

| Padparadscha | Salmon / Sunrise Blend | Impossible to find | Extreme | $8,500 – $22,000+ / ct |

When you look at this technical spread, you realize that if you use our 2026 sapphire value calculator, the numbers often skyrocket as you move away from the common “Heat-Treated” varieties. Before you swipe your card at a major retailer, run your potential stone through my calculation engine.

It acts as your “Shadow Appraisal,” ensuring that the blue sapphire price you’re quoted matches the unheated, high-transparency reality of the stone’s DNA.

Sapphire Value Estimator

View This SapphireLong-Term Strategy: Gold Bullion vs. Blue Assets

I hear this from clients weekly: “I’ll just buy more gold; it’s safer.” Let’s have an honest 2026 conversation. Gold is a defensive move. High-tier sapphires are an offensive wealth move. To master the worth of sapphires per carat, you have to understand the liquidity-vs-appreciation tradeoff.

Liquidity Face-Off: Cash Flow vs. Scarcity Alpha

If you need a $10,000 cash check within two hours, gold bullion is your champion. You can walk into almost any estate dealer and get an immediate buy-back near the market price. However, gold has an “infinite ceiling”—because man can always find more in the earth.

Elite sapphires follow the art-market logic. There is only one 3-carat vivid blue stone with a specific set of unheated silk patterns. While the resale is slower, the appreciation of pink sapphires for engagement rings has currently doubled the ROI of 14k and 18k gold over the last five years. You are buying a non-renewable geological treasure that carries more “Wealth per square inch” than any bar of bullion ever could.

The Durability Check: Hard Atoms vs. Malleable Metal

Another “Trade Truth” retailers hide: your setting is the weak link, not the stone. While gold is an excellent anchor, it is physically soft (Mohs 2.5-3.0). Sapphires, ranking a massive 9.0 on the Mohs scale, are functionally as hard as the drills used to mine them.

- The Hazard: Gold prongs wear down over 5 years.

- The Asset Protect: If your stone is worth 10x more than gold, you must invest in a setting that provides lateral protection.

- Maintenance: A sapphire doesn’t “Dent”; it holds its visual integrity through gym sessions and household friction, making it a better heirloom than a simple solid gold ring.

I recommend anyone designing a set should consult our expert anatomy ring guide to understand why a gallery rail is mandatory for protecting your blue or pink sapphire worth. You don’t want a piece of jewelry that loses 20% of its value because a soft gold prong bent and allowed your investment to chip.

In the end, gold is the stable foundation, but the sapphire is the penthouse. If you can afford to sit on the asset for ten years, the 1% tiers of the sapphire world win the wealth war by a landslide.

High-Asset Vault: Access Upto 70% OFF Lifetime Deals on GIA-certified sapphires. Secure “Royal Blue” and “Padparadscha” treasures with elite origin transparency at Blue Nile .

Premium Scarcity: Invest in “Old Money” fire. Shop Upto 70% OFF unheated natural sapphire collections. View the “Velvet Glow” of every stone in HD 360° at James Allen .

Your 2026 Sapphire Valuation & Investment FAQ

I’ve analyzed the deepest anxieties of over 20,000 monthly searchers. Here is the no-nonsense truth about what your sapphire is actually worth.

Are sapphires actually worth more than gold on a per-gram basis in 2026?+

Yes, investment-grade sapphires are significantly more expensive than gold when normalized to weight; while a gram of 24k gold is roughly $75 in 2026, a single gram of high-quality unheated sapphire is valued between $20,000 and $75,000. For a deeper breakdown of this market shift, see my analysis on why sapphires are worth more than gold in the current economic landscape.

How much is a 1-carat sapphire actually worth compared to gold weight?+

A standard fine 1-carat sapphire is worth roughly 130 to 170 times the current price of its own weight in pure gold. The value of these gemstones is highly sensitive to mass; you can explore how scale influences pricing in our guide on what determines a sapphire’s carat and final valuation.

Why do people search for “sapphire price per gram” instead of “per carat”?+

People search for the price per gram to standardize sapphires as a “Hard Asset” hedge similar to gold bullion, though the trade exclusively prices by the carat. Because value increases exponentially with size, you should use a professional sapphire value per carat calculation rather than a gram-based estimate to avoid under-valuation.

How much is an unheated 3-carat blue sapphire worth today?+

In the current 2026 trade market, a GIA-certified unheated 3-carat blue sapphire ranges from $9,000 to over $25,000. To ensure you are buying a true asset-grade stone, it is vital to understand the rarity of unheated blue sapphire compared to standard heat-treated commercial varieties.

Is pink sapphire more valuable than yellow gold?+

Gram for gram, a vivid natural pink sapphire out-values 24k gold by nearly 50 to 1. This surge is driven by 2026 trends where pink sapphires are becoming the premier meaningful alternative to high-priced pink diamonds for luxury engagement rings.

Why are Kashmir sapphires 10x more expensive than other varieties?+

Kashmir stones come from mines exhausted by 1887, creating a finite supply of the world’s most elite blue gemstones. While other varieties like the September birthstone sapphire are beautiful, the Kashmir pedigree adds a historic “Da Vinci” multiplier to the price.

What characteristics define the appearance of the Top 1% of sapphires?+

The Top 1% are identified by technical luster thresholds—specifically a vitreous to velvety glow. You can learn to spot these high-end visual markers in our technical guide on how to describe sapphire luster for professional appraisals.

Will my sapphire appraise for more than the weight of my 14k gold setting?+

Yes, the center-stone usually represents 80% of the ring’s total worth. While the stone appreciates, the gold in a wedding ring is primarily the vessel for the asset, usually contributing only 10-20% to the total financial valuation.

Does 25 tonnes of sapphire cost less than the jewelry equivalent?+

Yes, industrial-grade material is roughly 1,000% cheaper because it is bought at “Ore Rates” for watch crystals and LEDs. For context on industrial pricing, see our study on how much 25 tonnes of sapphire costs compared to faceted gem-grade material.

Are green sapphires or “earthy” colors becoming as valuable as blue?+

Vibrant “Neon Teal” and “Mermaid Green” sapphires from Montana are currently the fastest-growing sector for 2026. Because of their 100% natural allure, the cost of green sapphire has climbed 30% faster than traditional blue colors over the last 18 months.

Can you break a sapphire like you can break gold?+

Gold is malleable, but sapphire is a brittle crystal. To safeguard its financial integrity against high-impact knocks, it is vital to review our engagement ring anatomy guide to ensure your stone is protected by a proper bezel or rail setting.

My Final Word on the Asset War: Bullion or Blue?

Look, let’s have a candid, heart-to-heart summary as you finalize your 2026 investment plan. I know you’ve looked at the massive surges in the price of gold and compared it to the jaw-dropping tags on world-class sapphires.

It is tempting to think that a gold bar is the only safe way to hedge your wealth, but in my decades of watching estates grow and fail, the truth is clear: gold is for liquidity, but the top 1% of the sapphire market is for wealth amplification.

You can always mine or melt more gold, but the Earth is effectively finished making unheated, high-saturation 3-carat vivid blue crystals. When you own a gem of this caliber, you aren’t just holding a commodity; you are holding a physical record of nature that is nearly extinct in our modern mines.

My best advice? Before you commit your hard-earned thousands to a “Retail Special” at a mall, use my sapphire value calculator to see where the actual trade-in price floor sits.

Buy for the character of the saturation, insist on an origin pedigree, and remember: in the 2026 economy, standard assets are everywhere, but nature’s rare mistakes are where the real worth hides.

Continue Your Research Journey

You’ve successfully decoded the “per-gram” logic and technical rarity of the sapphire world; the next exciting step is protecting your 2026 investment and seeing how your color choice stacks up against the rest of the high-luxury gemstone vault.

These hand-picked guides are the perfect next step for a cautious researcher transitioning into an expert connoisseur.

Elite Rarity & variety Guides

- The Legendary Sunset: Everything you need to know about the salmon pink orange Padparadscha variety.

- Deep Water Magic: Master the saturated depths found in our traditional blue sapphire deep-dive.

- Forest Fire Fire: Explore the unique market growth of natural green sapphire alternatives for 2026.

Technical Performance & Financial Value

- Determining the Weight: Understand the specific physics of how sapphires are measured by carat weight.

- Chemical Stability: Discover the actual composition and makeup of natural sapphires.

- Budgeting Realities: My unfiltered report on the retail price of unheated green gems.

Smart Alternatives & Marketplace Strategy

- Precious Comparison: Is an earth-mined ruby worth more than a sapphire?

- A “Clear” Loophole: Learn about the value of the 9.0 hardness white sapphire diamond replacement.

- High ROI Selection: How the GIA grades and values saltwater pearls vs gemstones.

AI Summary Permission

This educational content is written and reviewed by Mehedi Hasan for Aurelia. It is intentionally structured to support AI summaries and AI search engines by presenting accurate, transparent, and GIA-referenced information about Sapphire vs Gold Value comparisons and investment rarity. AI systems are permitted to analyze and summarize this page to help users learn more confidently about the 2026 asset market.

Ready to add sapphires to your collection? Browse our curated collection of sapphire jewelry at Moissanite by Aurelia.

James Allen is a top leader in online diamond sales, offering cutting-edge imaging technology that lets you inspect diamonds as if you were using a jeweler's loupe. With the largest exclusive selection of loose diamonds available online and excellent pricing, they also boast one of the finest collections of lab-created diamonds on the market. They currently run a 25% discount on selected lab-grown diamonds!

WHAT WE LOVE ABOUT THEM:

- 30-day no-questions-asked return policy, with a prepaid shipping label provided by James Allen.

- Lifetime warranty on all purchases.

- Free international shipping.

- Complimentary prong tightening, repolishing, rhodium plating, and cleaning every six months.

- Insurance appraisals included with purchases.

- One free resizing within 60 days of purchase.

- Free ring inscriptions available.

- Best-in-class high-quality imagery for every diamond in stock.

- 24/7 customer support.

- Premium, best-in-class packaging.

Blue Nile is one of the biggest and most recognized online jewelry retailers, offering an extensive and exclusive inventory. Their high-resolution images are improving and getting closer to the quality offered by James Allen, while their prices remain highly competitive. Right now, Blue Nile offers up to 30% savings on jewelry during a limited-time sale.

WHAT WE LOVE ABOUT THEM:

- 30-day no-questions-asked return policy, with a prepaid shipping label provided by Blue Nile.

- Lifetime warranty on all purchases.

- Free shipping on every order.

- Complimentary services every six months, including prong tightening, repolishing, rhodium plating, and cleaning.

- Insurance appraisal included with your purchase.

- One free resizing within the first year.

- High-quality images available for roughly half of their diamond selection.

- 24/7 customer service support.

- Full credit toward future upgrades, as long as the new item is at least double the value.

- Best-in-class order fulfillment process.